If you are beginning to feel a little nervous about the state of the world, economically and politically, you may want to think twice about storing all of your gold in your home country.

Most of us like to keep at least some of our gold close to hand. But it also makes sense to think about keeping some of it in another country.

In the US, among a certain group of gold owners, there is a concern that the government might one day demand that its citizens give up their gold. This may sound weird, but it has happened once before.

In 1933 President Roosevelt issued an Executive Order, requiring that all US citizens relinquish their gold coins and gold bullion.

That order was finally repealed in 1974 by President Gerald Ford, but has left a lot of people feeling mistrustful. If the confiscation of gold happened before, it could happen again.

Personally, I think that’s unlikely. But it doesn’t do any harm to be cautious.

So what exactly is allocated or unallocated storage?

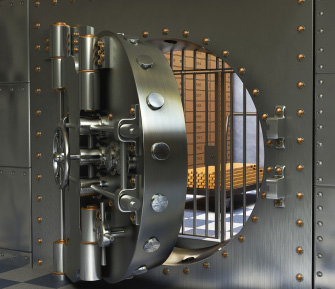

Put simply, it’s when you buy gold, but don’t take physical delivery of it. Your gold sits in a vault somewhere, maybe in the UK or in Switzerland. You own the gold, but never actually get to see it.

There are two forms of this type of storage – allocated storage and unallocated storage.

Allocated storage is when you buy an ounce of gold, for example, and own a particular, designated ounce in their vault. That one ounce coin has your name on it, and it’s yours.

Unallocated storage is when you buy that once ounce, and the company you are buying with simply makes a note that you now own one ounce of the gold in their vault.

In both cases, you can also choose to take delivery of your gold at some point in the future.

(You can find a more detailed explanation of allocated and unallocated gold storage here.)

Either way, this kind of service allows you to spread the risk. And that’s what owning gold is all about. We are putting some of our wealth into gold as a safe haven.

Storing at least part of your gold overseas allows you to protect yourself even further, in even the most extreme of economic or political circumstances.