As you know, Ben Bernanke, chairman of the Federal Reserve, recently outlined his plan for ongoing quantitative easing with QE3.

Basically the Fed will keep printing money, pass it down the line to the banks, and then hope it will stimulate some positive economic activity on Main Street. Will it work? Probably not. But we’ll find out soon.

That’s one of the key weaknesses of any currency than can be manipulated in this way. If you can create more of it out of thin air, how much confidence can you have in its true value?

Now let’s look at gold.

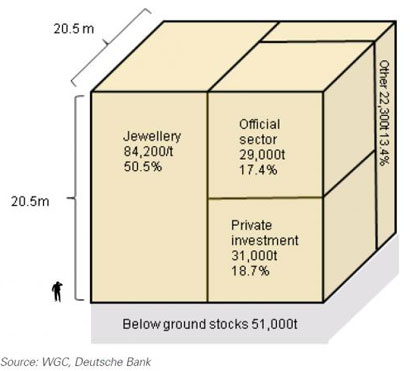

Here is a diagram that shows you the total amount of gold in the world, above and below ground.

By the way, if you measured that cube, each side would be about 68 feet. And that’s it. All the world’s gold can fit in that cube, plus what’s still in the ground. It’s a fixed amount. You can’t make more of it. You certainly can’t print it.

And that’s what makes gold the most reliable and trustworthy currency of them all. Because its supply is limited, you can measure its true value and never have to worry about people debasing it by magically creating more.

This is why gold is and has always been the reserve currency of choice. It’s why central banks all over the world are buying more and more gold. (China recently purchased 2 tons of gold from North Korea, and South Korea’s gold reserves were increased by 30% in July alone.)

For the same reasons, gold should be your reserve currency of choice. You can’t trust the US dollar right now, and you certainly can’t trust the Euro.

Oh, and you can’t trust the stock market either. Fidelity Investments, which built its business and reputation on stock funds, is now putting almost all of its money into bonds and money market accounts. When they lose confidence in stocks, it’s a sure sign that you and I can no longer trust the stock market as an arena for wealth creation or security.

Whether it’s the impact of QE3, or the lackluster performance of the stock market, or the economic slowdown in China, or the imminent implosion of the European Economic Union, all signs point to gold.

Gold is a trustworthy asset because you can’t print it. It’s wealth you can hold in your hand and trust absolutely.

About the author: DH Kenrick is a student of world economics and a committed gold enthusiast. Follow me on Google+

You can also follow Owning Gold on Facebook…