As with any other commodity, the price of gold rises and falls according to supply and demand.

And if you want to see where the demand is right now, look no further than the 1,336,718,000 inhabitants of China. Yes, that’s about one and a third billion people.

According to the head of the country’s largest state-owned gold miner, China National Gold Group, Chinese gold demand could rise over 22 percent in the next three years and could sharply outpace domestic production.

In other words, China will be importing gold just to keep up with domestic demand. And that isn’t because China doesn’t produce much gold. It does. In fact, China is the world’s largest gold producer and second-largest in overall consumption.

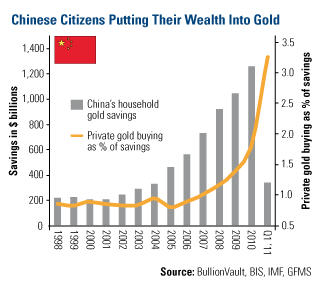

For an idea of the scale of that growth, take a look at this chart.

This isn’t showing the amount of money the state buys for its central bank. This is just the gold being purchased by some of those 1,336,718,000 individuals.

The total amount of household savings invested in gold has grown from about $200 billion in the late 1990s to $1.2 trillion in 2010.

Jewelry demand alone has more than doubled in the last seven years to 451.8 tons in 2010, from 224.1 tons in 2004.

In part, this demand is being fuelled by concerns about China’s growing level of inflation, which is currently about 5.3%. The higher that figure rises, the more people will turn to gold for security.

In the words of Song Qing, a director at Lion Fund Management Co., “Gold is increasingly being seen as an asset allocation choice. Just imagine the total wealth in China and even a small percentage of that choosing to buy gold. This demand is going to be enormous.”

What does this mean for you?

It means you should pay close attention to what is happening in China. With such a massive population, it will take only a small additional increase in gold purchases per capita to impact global gold markets significantly.

As always, buy gold to own, and keep it safe.

You can buy gold coins and gold bars online at GovMint.com.