What 2025’s Surge Really Means for Everyone Owning Gold

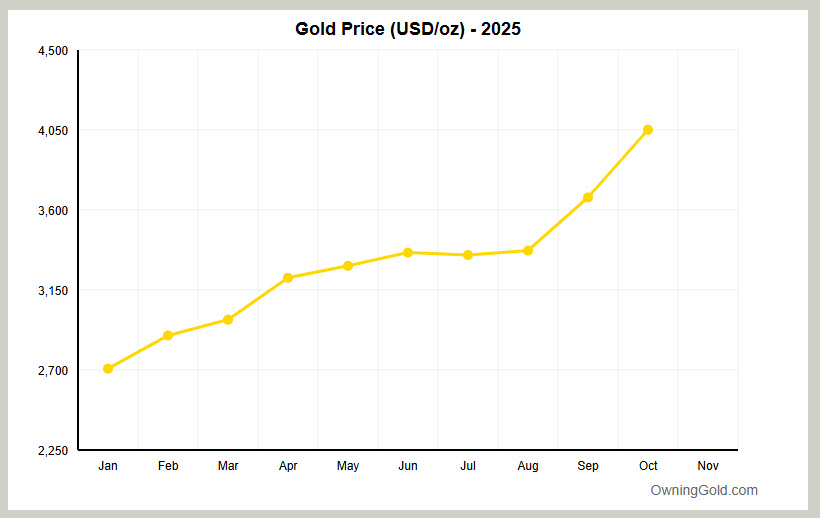

The gold market has a way of reminding us—often abruptly—why it has survived every economic era ever thrown at it. And here in 2025, after a breathtaking run-up that surprised even seasoned precious-metals veterans, many holders are left asking the same question: Is this the moment to add more, sit tight, or trim back? In …