Don’t get me wrong. I’m not suggesting you follow in Qaddafi’s footsteps. He’s a dictator, and deserves to be pushed out.

But there is one lesson we can learn from him.

He knows and has always known that things can go badly wrong for him. That comes with the territory when you’re an unpopular despot.

And that’s why he didn’t put all of his money into bank accounts, either domestic and foreign. He knew that when things go bad for you, bank accounts can be frozen.

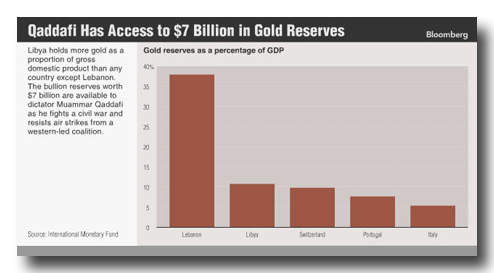

So he put over $7 billion dollars of his wealth into gold.

In fact, as you can see from this chart, other than Lebanon, Libya holds more gold as a proportion of its gross domestic product than any other country.

For you and me, it makes sense to be similarly cautious.

If things go badly wrong for us, either economically or politically, it makes sense to be able to access a good proportion of our wealth outside of the banking system.

We may not face the same kinds of problems as Colonel Qaddafi, but if you cast your mind back to 2008, you might remember that the money we hold in the banking system is not entirely secure.

Despots and dictators may not be able to teach us much, but they can teach us to be careful about where and how we store our wealth.