First, what are “central banks”?

According to Wikipedia: “A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries. In contrast to a commercial bank, a central bank possesses a monopoly on printing the national currency, which usually serves as the nation’s legal tender.”

In other words, they are key players in trying to ensure a country’s economic health and stability, both at home and internationally.

To be active and effective in these areas, Central Banks not only control a country’s money supply, but also hold reserves in foreign currencies and gold. These reserves give them power and stability.

And it used to be that Central Banks put a lot of their money into gold. Gold reserves served the same purpose as ballast in a ship’s hull. It was there to keep the vessel on an even keel during stormy weather…or turbulent economic times.

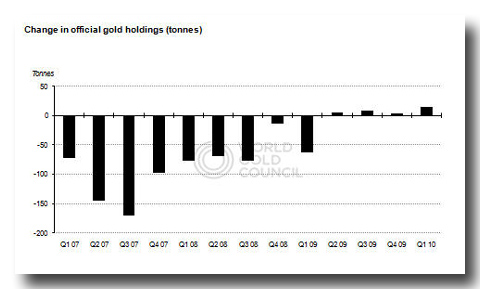

However, over the last few decades central banks have been selling their gold, by the ton. They decided that paper assets were a better bet. Of course, they decided that during a period of strong economic growth and stability.

Over the last two or three years their tune has changed, and many banks must be regretting the enthusiasm with which they sold their gold. They are buying it back now, but at a hugely increased price.

Take a look at this chart. You can see how the world’s Central Banks have reversed course and are now buying more and more gold. This is a significant reversal.

Why are they buying again? Because a Central Bank, just like a ship, needs ballast. And the rougher the weather, the more you depend on that ballast to survive the storm.

They are buying because they understand what is happening to markets globally. They understand the fragility of the world’s major currencies. They see how bonds are losing their shine. They have the same concerns you and I do about the debt in the U.S. and the bailouts in Europe.

Above all, they recognize that owning gold, as a physical asset, is the safest way to preserve your wealth and secure your future.

Well, if that is true for the world’s central banks, it’s also true for you and me.

Gold isn’t some relic from the past. Its value is highly relevant today. If it wasn’t, the Central Banks wouldn’t be buying so much of it right now.

That’s why now is the time to follow their example and buy more gold.