Do you own gold, in the form of gold coins or bars?

Do you know other people who own gold and store it at home or in a safety deposit box at the bank?

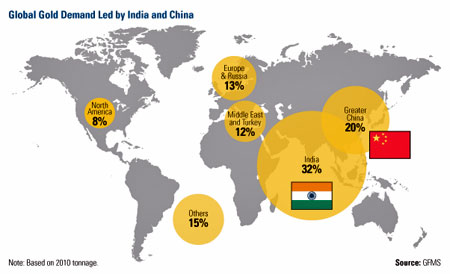

As you can see from the chart above, North America accounts for only 8% of the worldwide demand for gold.

By way of contrast, India and China together account for over 50% of demand.

In real terms, this means individuals in India and China are far more likely to hold a significant proportion of their family wealth in the form of gold.

Why? A lot of it is cultural. In both countries there is a tradition of giving gold as gifts. In India these gifts are often in the form of jewelry, particularly during the wedding season. And the Chinese have a thing for giving family members and friends elaborate gift boxes containing gold coins.

Meanwhile, here is North America it is still considered somewhat odd to buy and store gold coins or bars.

Now let’s consider a scenario, some time down the road – hopefully – when the world’s currencies take another huge hit and we fall into a serious depression.

Over in India, where their cost of living is lower, and generally the amount of money they need to spend each month is a lot less, they won’t be hit so hard. A simpler life is less vulnerable to swings in the economy. In addition, they will still be holding a significant proportion of their wealth in the form of gold. So if things get really bad, they can sell some of their gold.

This is the wrong way around. When your vulnerability to economic downturns is high, you should own more gold. When your vulnerability is lower, you need less gold.

Here in North America, because of our high spending levels and high debts, we are extremely vulnerable to downturns in the economy. But we do almost nothing to protect ourselves for when that day might come.

Makes no sense, right?

That’s why I encourage everyone to buy and own a higher proportion of their wealth in the form of physical gold. Do that and you’ll be well protected against even the most severe collapse in the value of the dollar or increase in interest rates, or both.

Go buy some gold!

About the author: DH Kenrick is a student of world economics and a committed gold enthusiast. Follow me on Google+

You can also follow Owning Gold on Facebook…